You probably know about Bitcoin, the digital currency, and you may know about blockchain, the underlying data technology. If not, you will soon. “Many tech futurists describe blockchain as one of the most disruptive and important discoveries of our ages,” writes tech strategist Tom Serres.

I’m in, and so is Jeremy Epstein, a “community driven marketing” evangelist at Never Stop Marketing (and frequent VentureBeat contributor), formerly CMO at social-tech star Sprinklr. Why? Blockchain “can handle vast amounts of information and value transfer at global scale relatively quickly,” Jeremy observes. In a data economy, these abilities are vital. Actually, more than vital, they’re revolutionary.

“The implication of blockchains is that we will move to decentralized organizations, societies, and means of production.”

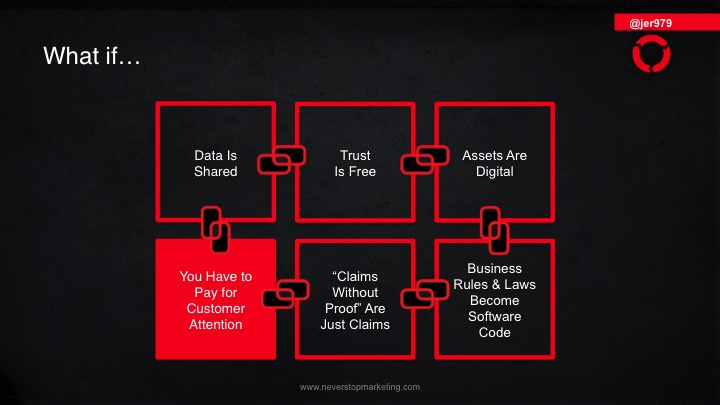

Blockchain provides a mechanism for decentralization and then beyond to foster “the convergence… of large technology trends – AI, 3D printing, robotics, drones, autonomous vehicles, Internet of Things, and more – all BASED on blockchains,” according to Jeremy. Marketing, consumer insights, and customer interactions are among the “and more” topics here, with implications for personal and corporate data ownership, sharing, privacy, and monetization, implications that touch on sentiment – on opinions, attitudes, and even emotional states – and not just on facts and transactions. These latter implications made Jeremy’s Sentiment Symposium Analysis speaking proposal, How Blockchain Technology Will Change Marketing, Sentiment Detection, and Customer Interaction, a must-accept. And they motivated this interview with Jeremy titled –

Blockchain Meets Customer. Enlightenment Ensues?

Seth Grimes> Jeremy, you recently stepped down as CMO at Sprinklr, a cloud social management provider. Enterprise social isn’t solved. Where are solutions heading – related to technologies, data, business functions, industries – and what elements are flat or passé?

Jeremy Epstein> Enterprise social is solved… in a sense because forward-thinking corporations recognize that it isn’t about social. It’s about the changes to the way that they do business that the arrival of social technologies requires. This change means a total focus on Customer Experience and having an enterprise-wide Customer Experience Management platform that is custom-built for a world driven by social interactions by customers.

What’s passé? Point solutions. Dead, gone, kaput. The direction has been – for a few years now – about having as integrated a customer experience across all functions, departments, silos, geographies as possible.

Seth> I agree that the social challenge is solved in the sense of “clear” – social is just one channel among many – but I do see unsolved enterprise social-related needs. One is ability to accurately measure “human signals” such as sentiment, emotion, and intent and link them to outcomes and provide predictive, and even prescriptive, insights. What’s your view?

Jeremy> I think you are right about human signals. We’re going to have to infer a lot more about people based on their behaviors. There will be micro-ones such ranging from how we swipe on an app, to major ones (how often we use tokens or trade assets).

And then, the most important part will be tying it all back to the “human” and emotional side.

Seth> You helped grow Sprinklr to 1,400 headcount, across multiple acquisitions. Why did you move on?

Jeremy> Sprinklr was – and is – doing great. My passion is helping bring innovative technologies into the mainstream. When I joined Sprinklr, we had 30 people and were valued at $20 million. Today, as you said, it’s 1,400 people and $1.8 billion valuation. There were 30 companies all vying for supremacy. Now, everyone knows Sprinklr as the leader.

My mission – which I certainly didn’t do by myself – had been accomplished.

Seth> Blockchain is fascinating. In essence, it’s a distributed, decentralized, tamper-proof records repository. Would you agree with that definition?

Jeremy> Yes. The technology is fascinating. Just like social though, I’m more focused on the implications of the arrival of the technology, in this case, the disintermediation of 3rd-party trust brokers.

Seth> Third-party trust brokers? Such as transaction platforms? How do consumers and businesses benefit?

Jeremy> The implications are vast. Third-party trust brokers of all kinds are an endangered species. Value will accrue in greater amounts to the people who created it and, I know this sounds crazy, I foresee a blockchain-empowered world where people are actually paid to do what they want to do anyway.

The reason why is that the data that we create has value for someone, somewhere. We’re going to be able to figure out ways of connecting the value each of us creates in the form of data to those who actually value it. Then, we’ll get paid in a crypto-currency for it. It could be a lot or a huge lump sum.

Consumers benefit from more choice, more freedom, and more security. Businesses will be able to have much greater clarity of the value they create at the individual level and optimize profitability for shareholders on a global scale at an individual level.

Seth> What are top resources you point people to, for a basic introduction or a more advanced appraisal?

Jeremy> I am working on a primer, as I get this question a lot. Alas, it’s not done yet. For the the time being, of course, I point to my blog where I write about this issue daily, www.neverstopmarketing.com/blog.

Also, people may also want to check out the free PDF of Blockchains in the Mainstream: When Will Everyone Else Know? which features 33 of the biggest names in the industry talking about the challenges of adoption.

Seth> You’ll be speaking at the June Sentiment Analysis Symposium on How Blockchain Technology Will Change Marketing, Sentiment Detection, and Customer Interaction. A key point I read in your talk description is that blockchain lets consumers own information about themselves and control how it’s used. Could you elaborate on the marketing and sentiment connections?

Jeremy> I’m very excited to present some of the context to your attendees and hear their thoughts on it since I’m still trying to figure it out myself. The basic idea, however, is that in a blockchain world, we will all control our own identities and, on a permission basis, give organizations access to that information. As such, many companies won’t actually even know who a customer is and thus, it’s difficult to track behavior as we now think of it.

For example, I have a BitPay wallet to store my Bitcoin, but BitPay has NO idea that I’m one of their customers… they don’t know anything about me other than a wallet with a given address has a certain amount of Bitcoin in it. Given that, how do they market to me and figure out how I feel?

Seth> Presumably there’ll still be a role for data aggregators and new ways to entice (read: bribe) consumers to give up their data. But does blockchain enable NEW marketing and targeting possibilities?

Jeremy> Yes. You can see my recent post on Venture Beat about Data Industrialization, This was a big week for blockchain.

The new marketing possibilities stem from an increased focus on UX and tokens/coins as loyalty. Remember, in this world, every token holder is basically a network stakeholder so customer evangelism is baked in. Frankly, I’m still exploring this, but there are many new possibilities. We’ll talk more at the panel.

Seth> What has the pace of uptake been like, by consumers and for consumer-facing functions? And what will it look like in the near to medium term, the next couple of years?

Jeremy> For consumers, it’s slow. There are MANY hurdles and it’s not easy, even for technophiles.

That’s going to change.

The thing that is really catching me off guard is just how quickly the technological pace of advancement is occurring. When I started in this industry full time back in September, I told people that I thought we were about 5 months before Opening Day. Now, while the season hasn’t fully started yet, we are certainly in training camp, as evidenced by the number of pilots going on worldwide in every industry imaginable.

Seth> How can and should individuals involved in research and insights – at consumer-facing or B2B organizations – take advantage of blockchain now. How should they prepare and position themselves for future use?

Jeremy> It’s a good question and I think it comes down to understanding that blockchain offers a shared data layer that everyone can see. Given that, what are the necessary steps that an organization can take to get unique insights about the market? My hunch is that AI is going to play a big role here. Also, understanding how “thin” apps can be sources of unique insights. Remember, BitPay may not know I’m a customer, per se, but they can watch the behavior in the app of all of their customers so that they can develop more finely tuned offerings.

At the industry layer, however, there will be one common data source that everyone has. That’s a pretty big deal.

We’ll talk about all of this at the sentiment symposium!